Bootstrap Training by Experts

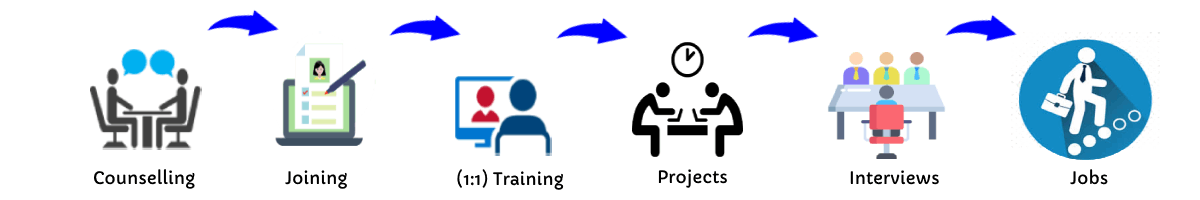

Our Training Process

Bootstrap - Syllabus, Fees & Duration

MODULE 1

- Bootstrap

- Get Started

- What is Bootstrap?

- Bootstrap History

- Why Use Bootstrap?

- Where to get Bootstrap?

- Downloading Bootstrap

- Bootstrap CDN

MODULE 2

- Create First Web Page with Bootstrap

- Add the HTML5 Doctype

- Bootstrap is Mobile First

- Containers

- Basic Bootstrap Pages

- Bootstrap Grids

- Bootstrap Grid System

- Grid Classes

- Basic Structure of a Bootstrap Grid

- Equal Columns

- Unequal Columns

MODULE 3

- Bootstrap Text / Typography

- Bootstrap Default Settings

- Bootstrap vs. Browser Defaults

- Bootstrap Tag Elements

- Contextual Colors and

- Background

- Typography Classes

MODULE 4

- Bootstrap Table

- Rounded Corners

- Circle

- Thumbnail

- Responsive Images

- Image Gallery

- Responsive Embeds

MODULE 5

- Bootstrap Jumbotron and Page Header

- Creating a Jumbotron

- Jumbotron inside Container

- Jumbotron outside Container

- Creating a Page Header

MODULE 6

- Bootstrap Wells

- Wells

- Well Size

MODULE 7

- Bootstrap Alerts

- Alerts

- Closing Alerts

- Animated Alerts

MODULE 8

- Bootstrap Buttons

- Button Style

- Button Sizes

- Block Level Buttons

- Active /Disable Buttons

MODULE 9

MODULE 10

- Bootstrap Glyphicons

- Glyphicons

- Glyphicons Syntax

- Glyphicon Example

MODULE 11

- Bootstrap Badges and Labels

- Badges

- Labels

MODULE 12

- Bootstraps Progress Bars

- Basic Progress Bar

- Progress Bar with Label

- Colored Progress Bars

- Striped Progress Bars

MODULE 13

- Bootstrap Pagination

- Basic Pagination

- Active State

- Disabled State

- Pagination Sizing

MODULE 14

- Bootstrap Pager

- What is Pager?

- Align Buttons

MODULE 15

- Bootstrap List Groups

- Basic list Groups

- List Group with Badges

- List Group with Linked Items

- Contextual Classes

- Custom Content

MODULE 16

- Bootstrap Panels

- Panels

- Panel Heading

- Panel Footer

- Panel Group

- Panel with Contextual Classes

MODULE 17

- Bootstrap Dropdowns

- Basic Dropdown

- Dropdown Driver

- Dropdown Header

- Disable an Item

- Dropdown Accessibility

- Bootstrap Collapse

MODULE 18

- Basic Collapsible

- Example Explained

- Collapsible Panel

- Collapsible List Group

- Accordion

MODULE 19

- Bootstrap Tabs and Pills Menus

- Tabs

- Tabs with Dropdown Menu

- Pills

- Vertical Pills

- Vertical Pills in Row

- Pills with Dropdown Menu

- Centered Tabs and Pills

- Toggle/Dynamic Tabs

- Toggle/Dynamic Pills

MODULE 20

- Bootstrap Navigation Bar

- Navigation Bars

- Inverted Navigation Bar

- Fixed Navigation Bar

- Navigation Bars with Dropdown

- Right Aligned Navigation Bar

- Collapsing the Navigation Bar

MODULE 21

- Bootstrap Forms

- Bootstrap Default Settings

- Bootstrap Form Layouts

- Bootstrap Vertical Form

- Bootstrap Inline Form

- Bootstrap Horizontal Form

- Bootstrap Form Inputs

- Supported Form Controls

MODULE 22

- Bootstrap Input

- Bootstrap Text area

- Bootstrap Checkboxes

- Bootstrap Radio Buttons

- Bootstrap Select List

MODULE 23

- Bootstrap Form Inputs (More)

- Static Control

- Bootstrap Form Control States

MODULE 24

- Bootstrap Input Sizing

- Input Sizing in Forms

- Height Sizing

- Column Sizing

- Help Text

MODULE 25

- Bootstrap Carousel Plugin

- The Carousel Plugin

- How to Create a Carousel

- Add Captions to Slides

MODULE 26

- Bootstrap Model Plugin

- The Model Plugin

- Hoe to Create a Model

- Model Size

MODULE 27

- Bootstrap Tooltip Plugin

- The Tooltip Plugin

- How to Create Tooltip

- Positioning Tooltips

MODULE 28

- Bootstrap Popover Plugin

- The Popover Plugin

- How to Create a Popover

- Positioning Popovers

- Closing Popovers

MODULE 29

- Bootstrap Scrollspy Plugin (Advanced)

- The Scrollspy Plugin

- How to Create a Scrollspy

- Scrollspy Vertical Menu

MODULE 30

- Bootstrap Case

- Build a Bootstrap Web Page

- From Scratch

- Add Bootstrap CDN and Put

- Elements in Containers

- Add Jumbotron

- Adding button and icons

- Multicolumn Layout

- Adding Menus Tabs

- Adding Navigation bars

This syllabus is not final and can be customized as per needs/updates

If you have a project or an idea that you want to put into a website, offer it to our trainers during the course and they will assist you in working on it. It's a broad framework that only worries about front-end applications, such as topography, forms, interface components, and JavaScript plugins. This Bootstrap course focuses on business-related innovations.

This Singapore course teaches you how to use Bootstrap to create responsive web siteswebsitesl be able to create Bootstrap-based websites after completing the NESTSOFT Bootstrap course. This course is intended for advanced Bootstrap starters. Fewer cross-browser issues are among the key benefits of bootstrap.

The Bootstrap course from NESTSOFT is meant to introduce you to the Bootstrap framework and mobile-first web design. Learn how to use Bootstrap Dismissible alerts, make badges, use Bootstrap Breadcrumbs, and design and align Buttons and Button groups. Bootstrap is a front-end framework that uses CSS and HTML to create bespoke designs. ) created Bootstrap to bring consistency to what were previously disparate libraries in web development.

If you have a project or an idea that you want to put into a website, offer it to our trainers during the course and they will assist you in working on it. It's a broad framework that only worries about front-end applications, such as topography, forms, interface components, and JavaScript plugins. This Bootstrap course focuses on business-related innovations.

This Singapore course teaches you how to use Bootstrap to create responsive web siteswebsitesl be able to create Bootstrap-based websites after completing the NESTSOFT Bootstrap course. This course is intended for advanced Bootstrap starters. Fewer cross-browser issues are among the key benefits of bootstrap.

The Bootstrap course from NESTSOFT is meant to introduce you to the Bootstrap framework and mobile-first web design. Learn how to use Bootstrap Dismissible alerts, make badges, use Bootstrap Breadcrumbs, and design and align Buttons and Button groups. Bootstrap is a front-end framework that uses CSS and HTML to create bespoke designs. ) created Bootstrap to bring consistency to what were previously disparate libraries in web development.